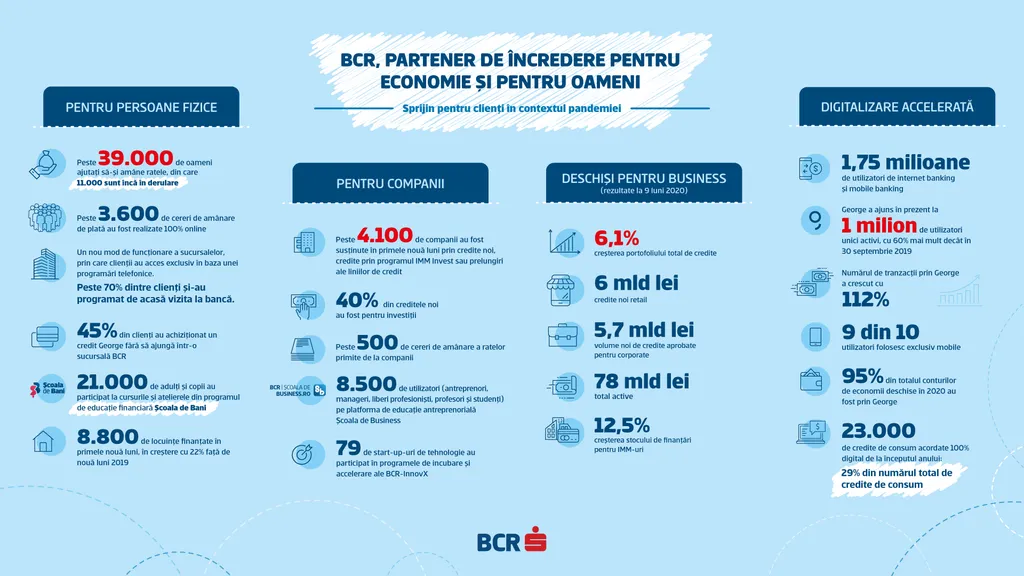

BCR, 1-9 2020 financial results: George reached 1 million active users. Proactive consultancy for private individuals and entrepreneurs, with fast decisions for the benefit of the customers

- Accelerated digitization:

o 1,75 million users for internet and mobile banking, out of which over 1 million unique active users in George, up by 60% as compared to 9M 2019

o The number of digital transactions in George increased by 112% yoy in 9M 2020

o 95% of the new savings accounts in 9M 2020 were opened through George platform

o 23,000 cash loans granted on fully digital flow since the beginning of the year, reaching 29% of the total number of cash loans

- Open for business:

o The stock of net customers loans granted by Banca Comerciala Romana (BCR) advanced by 6.1% yoy as of 30 September 2020 supported by both retail and corporate segments

o New loans in local currency of RON 6 billion granted in 9M 2020 for households (mortgage and unsecured consumer) and micro-businesses

o Over RON 5.7 billion new approved corporate loans in 9M 2020, of which 50% investment loans

o Support for entrepreneurs, stock of financing for SME segment up by 12.5% yoy as of 30 September 2020

- Support for customers in the current context:

o Deferred instalments for 39,000 loans for individuals, of which only 11,000 have still an active payment holiday agreement, and for 500 loans for companies, majority choosing BCR solution.

o Over 4.100 companies were supported through new loans, financing through the SME Invest programme and credit extensions

BCR achieved a net profit of RON 845.8 million (EUR 175.2 million) in 1-9 2020

“2020 has been a year of fast change, adapting to what the future should have brought in a few years. This year has not been BCR’s first storm, nor was it our first time running a marathon in a record time. It has been a new kind of challenge, and I am grateful to our customers and our team for their contribution and dedication in reinventing banking on fast forward and united. We supported our customers, listening and learning from them, with customized solutions, financial and entrepreneurial education. Furthermore, we transformed George, the intelligent banking platform, in one of the most complete and evolving digital banking ecosystems, based on the main indicator that drives progress in the industry – customer experience”, stated Sergiu Manea, CEO Banca Comercială Română.

Measures taken in the context of Covid-19

· Deferred instalments for about 39,000 loans for individuals and 500 loans for companies, majority choosing BCR solution. Only 11,000 loans for individuals are still ongoing, having an active payment holiday agreement. Over 3,600 deferred instalments requests were made through a fully digital flow in George.

· Presently, the deferred instalments represent 4% out of the total loan portfolio for individuals, respectively 10% of the total loan portfolio for non-financial companies.

23,000 cash loans granted on fully digital flow since the beginning of the year, reaching 29% of the total number of cash loans. The number of customers taking a cash loan without accessing a retail unit reached 45%.

· Around 53% of the customers who applied for a 100% online cash loan opted also for a life, unemployment, temporary or permanent loss of work capacity insurance.

· The bank has implemented a new operational model in the retail units, based on which customers have access in branches only through a phone appointment. Already 70% of customers have scheduled their visit to the bank from home.

BCR impact in the economy

In retail banking business, BCR generated total new loans in local currency to individuals and micro businesses of RON 6 billion in 9M 2020 mainly driven by standard mortgage and cash loans. Cash loan sales decreased by 4.4% yoy in 9M 2020, however up by 50% qoq partly recovering after Q2 economic lockdown in the pandemic context. Mortgage new sales strongly up by 38% yoy in 9M 2020 fully driven by standard product, while state-guaranteed mortgage loan sales down yoy due to late approval of the new conditions. New loans to micros down by 12.4% yoy in 9M 2020, though up by 69% qoq.

In corporate banking business, BCR (bank standalone) approved new corporate loans of RON 5.7 billion in 9M 2020. The stock of financing for SME segment (including BCR Leasing subsidiary) increased by 12.5% yoy to RON 6.7 billion (EUR 1.4 billion) as of 30 September 2020, as a result of a high focus on new business and advance in leasing and BCR’s participation in SME Invest program. Public Sector financing increased by 16.0% yoy. Real Estate segment increased by 14.5% year-on-year on drawdowns within the office and commercial projects financed over the last year.

The intelligent banking platform George reached 1 million unique active users, up by 60% as compared to 9M 2019. The number of transactions through George increased by 112% in 9M 2020 as compared to the same period in 2019. Nine out of ten users prefer the mobile version. Foreign currency accounts through George increased by 200% in 9M 2020, as compared to the similar period of last year. George Moneyback, the loyalty program that offers money back in return, as discount, when customers use card payments, reached 230,000 users in just three months.

The shared online platform Casa Mea App, that runs document workflow for proprietary mortgage, has been used for 43% of the total 8.800 disbursed mortgage loans.

The Money School programme reached 21,000 adults and children in 9M 2020, having organized financial education online sessions for adults and dedicated workshops for children.

The entrepreneurial education platform The Business School reached over 8,500 users (entrepreneurs, managers, freelancers, teachers and students). In addition, BCR team organized online sessions with over 1,000 entrepreneurs, in which BCR team discussed about the main indicators that banks look for when they lend.

BCR-INNOVX Accelerator has selected 10 technology firms for Scaleups group (with turnover or attracted financing over EUR 1 million), reaching, in less than two years, 79 start-ups from all over the country that have participated in the incubation and acceleration programs.

1-9 2020 financial highlights

BCR achieved a net profit of RON 845.8 million (EUR 175.2 million) in 1-9 2020 from RON 348.8 million (EUR 73.6 million) in 1-9 2019 underpinned by higher operating performance and significant advance in new lending, partly offset by higher risk costs. The net profit in 2019 was affected by significant one-off provision allocation related to the activity of BCR Banca pentru Locuinte booked in Q2 2019.

Operating result improved by 6.6% to RON 1,403.7 million (EUR 290.8 million) in 1-9 2020 from to RON 1,317.4 million (EUR 278.0 million) in 1-9 2019, on the back of higher operating income along with lower operating expenses.

Net interest income increased by 5.7% to RON 1,778.6 million (EUR 368.5 million) in 1-9 2020, from RON 1,683 million (EUR 355.2 million) in 1-9 2019, favoured by higher loan volumes in both retail and corporate, partly offset by impact from lower money market interest rates.

Net fee and commission income decreased by 13.3%, to RON 501.7 million (EUR 103.9 million) in 1-9 2020, from RON 578.9 million (EUR 122.2 million) in 1-9 2019, driven by lower cash withdrawal and waived withdrawal fee at non-BCR ATMs in April and May as support measure during the state of emergency.

Net trading result increased by 2.2%, to RON 256.7 million (EUR 53.2 million) in 1-9 2020, from RON 251.1 million (EUR 53.0 million) in 1-9 2019, mainly driven by higher trading activity.

Operating income increased by 1.2%, to RON 2,618.5 million (EUR 542.5 million) in 1-9 2020, from RON 2,587.4 million (EUR 546.0 million) in 1-9 2019, driven by higher net interest income and net trading result, partly offset by lower fee income.

General administrative expenses reached RON 1,214.8 million (EUR 251.7 million) in 1-9 2020, down by 4.3% in comparison to RON 1,270.0 million (EUR 268.0 million) in 1-9 2019, mainly due to lower contribution to deposit insurance fund in 2020 versus 2019 and lower depreciation, partly offset by higher personnel expenses and costs related to new head office in 2020.

As such, cost-income ratio improved to 46.4% in 1-9 2020, versus 49.1% in 1-9 2019.

Risk costs and Asset Quality

Impairment result from financial instruments recorded an allocation of RON 277.5 million (EUR 57.5 million) in 1-9 2020, as compared to a release of RON 122.8 million (EUR 25.9 million) in 1-9 2019. This result has been mainly influenced by updated risk parameters to reflect the expected economic downturn coupled with the implementation of stricter rules for credit risk classification under IFRS 9 applied to client exposures affected by the current situation.

NPL ratio reached 4.4% as of September 2020, slightly higher than 4.1% recorded at December 2019. This evolution is reflecting the effect of a one-off large new default registered in the corporate segment in Q2 2020, after a long period of almost no new NPL formation, coupled with continuous trend of recoveries in both retail and corporate segments. At the same time, the NPL provisioning coverage reached 119.6% as of September 2020.

Capital position and funding

Solvency ratio for BCR Bank standalone, according to the capital requirements regulations (CRR) stood at 21.4% as of August 2020, well above the regulatory requirements of the National Bank of Romania. Furthermore, the Tier 1+2 capital ratio of 20.5% (BCR Group) as of June 2020 is clearly showing BCR’s strong capital adequacy and continuing support of Erste Group. In this respect, BCR enjoys one of the strongest capital and funding positions amongst the Romanian banks.

Loans and advances to customers increased by 4.7% to RON 41,935.1 million (EUR 8,606.5 million) as of 30 September 2020 from RON 40,049.0 million (EUR 8,373.2 million) as of 31 December 2019, supported by increases in both retail (+6.8% ytd) and corporate (+2.4% ytd).

Deposits from customers increased by 5.2% to RON 60,796.6 million (EUR 12,477.5 million) as of 30 September 2020 versus 57,791.8 million (EUR 12,082.8 million) as of 31 December 2019, supported by increases in both retail (+6.1% ytd) and corporate (+1.5% ytd) deposits.

***

BCR provides a full range of financial products and services, through a network of 17 business centers and 16 mobile offices dedicated to companies and 371 retail units located in most cities across the country with over 10,000 inhabitants. BCR is the No. 1 bank in Romania in the market of bank transactions, BCR customers having available the largest national network of ATM and multifunctional machines- almost 1,830, approximately 12,700 POS and complete services of Internet banking, Mobile banking, Phone-banking and E-commerce.

***

For more information please contact press office at: comunicare@bcr.ro

This information is also available on our website: www.bcr.ro

For more details about the products and services provided by BCR, please contact InfoBCR at

- Internet page: www.bcr.ro

- Email: contact.center@bcr.ro

- Telverde: *227, toll-free from all national networks

1Below stated financial data are un-audited, consolidated business results of Banca Comercială Română Group for 1-9 2020, according to IFRS. Unless otherwise stated, financial results for 1-9 2020 are compared to financial results for 1-9 2019. Also, if not stated otherwise, foreign exchange rates used for conversion of figures into EURO are the ones provided by the European Central Bank. The income statement is converted using the average exchange rate for 1-9 2020 of 4.8270 RON/EUR when referring to 1-9 2020 results and using the average exchange rate for 1-9 2019 of 4.7385 RON/EUR when referring to the 1-9 2019 results. The balance sheets at 30 September 2020 and at 31 December 2019 are converted using the closing exchange rates at the respective dates (4.8725 RON/EUR at 30 September 2020 and 4.7830 RON/EUR at 31 December 2019, respectively). All the percentage changes refer to RON figures.